Eris Lifesciences Acquires Biocon Biologics’ India Branded Formulation Biz for INR 1,242 Cr

The deal, financed through debt, is expected to be finalized by April 15, 2024, subject to customary closing conditions.

In a significant development within the pharmaceutical sector, Ahmedabad-based Eris Lifesciences has announced the acquisition of the domestic branded formulation business of Biocon Biologics Ltd for INR 1,242 Cr.

This strategic move aims to expand Eris's presence in the Indian market and venture into the lucrative injectables segment, valued at over INR 30,000 Cr. The deal, financed through debt, is expected to be finalized by April 15, 2024, subject to customary closing conditions.

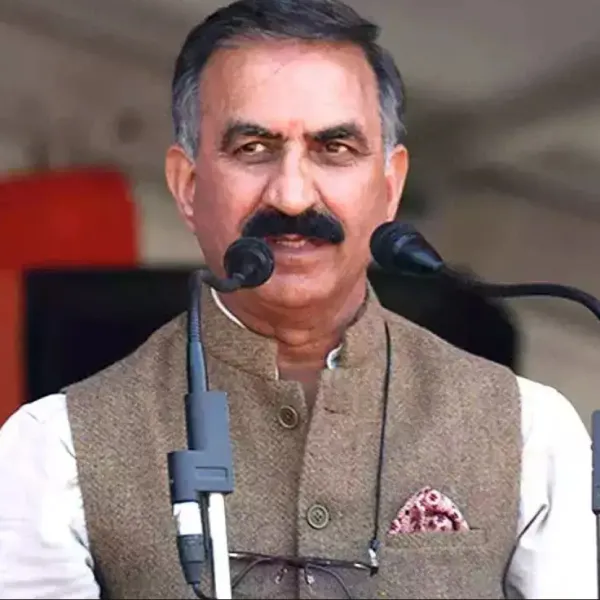

Emphasizing the strategic importance of the collaboration, Shreehas Tambe, CEO & MD of Biocon Biologics, said, "This strategic collaboration with Eris Lifesciences for our portfolio of metabolic, oncology, and critical care products in India aligns with our commercial strategy to maximize patient reach and market potential."

Market Expansion Strategy

The acquisition brings two major insulin brands, Basalog and Insugen, into Eris's portfolio, positioning the company as a key player in the Indian pharmaceutical sector.

Additionally, the acquisition will mark Eris's entry into the injectables market and facilitate its expansion into oncology and critical care segments. These segments, with market shares of over 10%, are anticipated to provide growth opportunities for Eris Lifesciences.

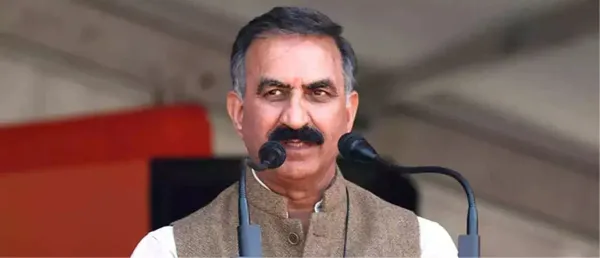

Sharing insights, Amit Bakshi, chairman & managing director of Eris Lifesciences Ltd, said, "This deal, combined with the acquisition of Swiss Parenterals that we announced last month, will turbocharge our entry into the India Branded Injectables market and pave the way for our next INR 1,000 Cr vertical in the next 3-4 years."

Employee Transition & Financial Outlook

Per the deal, the transaction includes over 430 employees transitioning from Biocon Biologics to Eris, ensuring continuity for employees and patients.

Additionally, the collaboration is expected to provide immediate synergies with the recently acquired Swiss Parenterals business. Eris Lifesciences commented on this, "Under this agreement, the Biocon product range will continue to be manufactured and supplied to Eris for commercialization in India."

Furthermore, following the announcement, Biocon's shares surged by 5.8%, indicating investor confidence in the strategic collaboration. Meanwhile, Eris Lifesciences' stock closed on Thursday with a 3.8% gain.

Expansion beyond the Acquisition

In a preceding strategic move, Eris Lifesciences Ltd had acquired Biocon Biologics' dermatology and nephrology branded formulations business units in India. The transaction, valued at INR 366 Cr, included partial funding through debt financing. This acquisition complemented Eris's existing medical dermatology offerings and significantly expanded its portfolio with over 20 mother brands.

Under this acquisition, Eris Lifesciences gained access to notable legacy brands such as Tacrograf and Renodapt in organ transplants, along with emerging brands like Bionesp and Erypro in chronic kidney disease-induced anemia. With these additions, Eris's medical dermatology offerings, including Psorid, Tbis, Picon, and Calpsor, were further enhanced, consolidating the company's position in the dermatology and nephrology segments.

Historically, Eris has used acquisitions to diversify its therapeutic reach. They entered neuropsychiatry in 2017 through the acquisition of Strides Shasun's domestic business, and in 2022, they expanded into dermatology by acquiring Oaknet Healthcare.

This was followed by acquiring brand portfolios from Glenmark and Dr Reddy's in early 2023.

Stay tuned for more such updates on Digital Health News