W Health Sets Up $70 Mn Fund II to Build AI-Driven Healthcare Startups

Moreover, the firm plans to invest $3–5 million in each startup initially, with an equal amount reserved for follow-ons. The final corpus may expand up to $100 million by the time of fund close.

W Health Ventures has launched a $70 million second fund to build and scale healthcare startups from the ground up, with a sharp focus on India and global markets.

The fund will support the creation of 8 to 10 startups over the next four years using the firm’s in-house company-creation model.

Founded in 2019, W Health Ventures has positioned itself as a healthcare-focused venture capital firm with a unique approach: rather than investing in external startups, it incubates ideas internally, validates them, and brings in founding teams later.

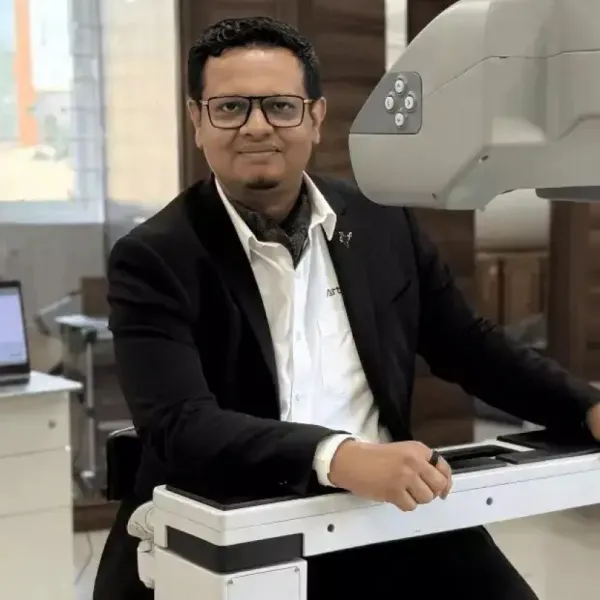

“Fund II really doubles down on our company creation model,” said Dr Pankaj Jethwani, Managing Partner at W Health Ventures. “It’s something that we’ve built through a lot of trial and error over the last several years.”

Moreover, the firm plans to invest $3–5 million in each startup initially, with an equal amount reserved for follow-ons. The final corpus may expand up to $100 million by the time of fund close.

As per reports, Fund II has already made its first investment in EverHope Oncology, a joint venture with Narayana Health and venture studio 2070 Health.

With EverHope, W Health aims to address cancer care gaps in India through standardized treatment protocols and modern infrastructure.

“The journey of a patient with cancer, if you have all the means in the world, might be average at best. If you don’t, life is very hard,” said Jethwani. “It doesn’t have to be this way.”

The firm is also building a second startup, currently in stealth, focused on a managed services platform for psychiatry clinics in the US. The company will combine AI, automation, and offshore support to improve clinical operations for treatment-resistant depression.

“AI is no longer optional when building a company, including in healthcare, though it doesn’t always have to be the primary product,” Jethwani said. “The technology is crucial for embedding convenience and high-quality care at every step.”

Additionally, the fund will target two core themes: single-specialty care delivery platforms that fill critical gaps in India’s healthcare system, and AI-enabled B2B healthcare services for US-based firms. These AI-led platforms are designed to leverage India’s clinical and engineering talent to deliver high-quality, cost-efficient healthcare solutions globally.

“Healthcare innovation in India remains 10–15 years behind global benchmarks. This gap is a generational opportunity,” Jethwani said. “As India’s healthcare sector reaches a critical inflection point, we are focused on building category-defining companies from scratch, by design, not by chance.”

W Health’s company creation model draws from extensive interviews with clinicians and patients to identify underserved areas. Ideas are tested rigorously, and only those with high conviction are pursued.

“Ninety-three percent of our ideas get killed,” Jethwani noted. “The kind of conviction we’re able to build before we launch a company makes us go all in.”

W Health’s first fund of around $50 million backed 12 startups including BeatO (diabetes), Mylo (parenting), BabyMD (pediatrics), and Wysa (AI-enabled mental health). Several were incubated internally in partnership with 2070 Health.

As India’s digital health sector matures, W Health’s fund comes amid renewed interest in vertical-focused VC strategies. “We believe AI-enabled healthcare services will be India’s biggest gift to the world after pharma,” Jethwani. added.

Stay tuned for more such updates on Digital Health News