Know Labs to Acquire 1,000 Bitcoin as Greg Kidd Takes Control

The statement noted that Kidd will assume the role of Know Labs’ CEO upon the deal's completion.

Know Labs, a public health technology firm, has announced plans to acquire 1,000 Bitcoin, valued at approximately $105 million.

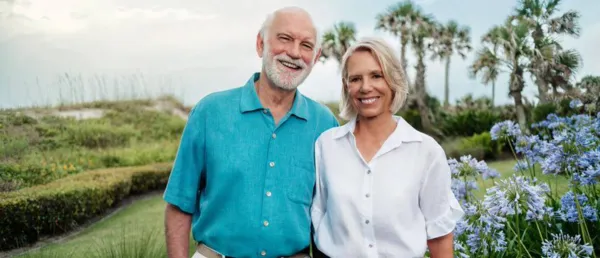

The announcement was made in a statement revealing that fintech investor Greg Kidd will acquire a controlling interest in the company.

“I’m thrilled to deploy a Bitcoin treasury strategy with the support of a forward-looking organization like Know Labs at a time when market and regulatory conditions are particularly favorable,” Kidd said.

“We believe this approach will generate sustainable growth and long-term shareholder value,” he added.

Bitcoin was trading at around $105,031 at the time of the announcement, up 8% over the past month, according to CoinGecko. Shares of Know Labs were priced at $0.87 on Friday, reflecting a 71% increase since Thursday’s close.

The statement noted that Kidd will assume the role of Know Labs’ CEO upon the deal's completion.

Kidd is recognized for early-stage investments in technology and crypto companies, including Twitter, Coinbase, Solana, Block, and Robinhood.

The move comes amid a broader trend of publicly traded companies adding Bitcoin to their treasuries, inspired by the strategy of firms like Strategy, which currently holds nearly $61 billion worth of Bitcoin.

According to a June 3 report from Standard Chartered, at least five dozen public companies have established Bitcoin reserves, many of which have not traditionally been involved in the crypto sector. Norwegian Block Exchange, SolarBank, and now Know Labs have all recently indicated plans to purchase Bitcoin.

Public companies are also beginning to explore reserves in altcoins such as Solana, XRP, and Ethereum.

This wave of interest aligns with recent regulatory changes in the US under President Donald Trump’s administration, which has implemented a pro-crypto policy direction. Key regulatory agencies, including the CFTC and SEC, have experienced leadership changes, replacing crypto-skeptic officials with more technology-aligned personnel.

In addition, Trump signed several executive orders earlier this year that promote cryptocurrency adoption. These directives included provisions for the US Treasury to accumulate digital assets and introduced crypto mining and self-custody protections.

Stay tuned for more such updates on Digital Health News