New Mountain Capital Acquires Majority Stake in Access Healthcare

The acquisition positions Access Healthcare for accelerated growth under New Mountain Capital’s guidance.

US-based investment firm New Mountain Capital has acquired a majority stake in Access Healthcare, a healthcare BPO specializing in revenue cycle management (RCM) services.

The acquisition positions Access Healthcare for accelerated growth under New Mountain Capital’s guidance.

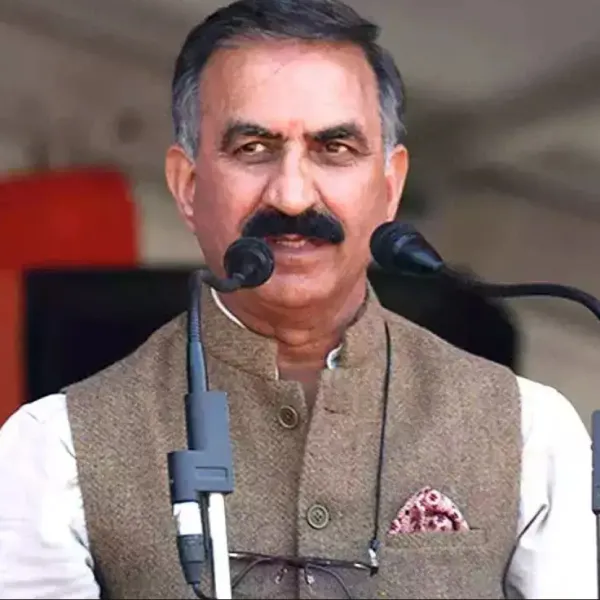

“New Mountain’s deep experience in healthcare and provider technology, as well as its philosophy of building great businesses, will help accelerate Access Healthcare in this next growth phase,” said Matt Holt, MD and President, Private Equity at New Mountain.

Financial Details

The transaction, which sources indicate values Access Healthcare at $2 billion, gives New Mountain Capital a 70-75% ownership stake. The investment highlights the increasing demand for outsourcing solutions in healthcare, particularly in revenue cycle management.

Access Healthcare, established in 2012 by Indian-origin entrepreneur Anurag Jain, operates 20 global delivery centers across India, the Philippines, and the US.

The company focuses on medical billing, coding, and accounts receivable management and has major operations in Indian cities, including Chennai, Mumbai, Pune, and Noida.

New Mountain Capital, managing over $55 billion in assets, has a track record of investments in healthcare and outsourcing.

Previous investments include acquiring Indian healthcare BPO emits in 2019 and a significant stake in Accolite Digital in 2021.

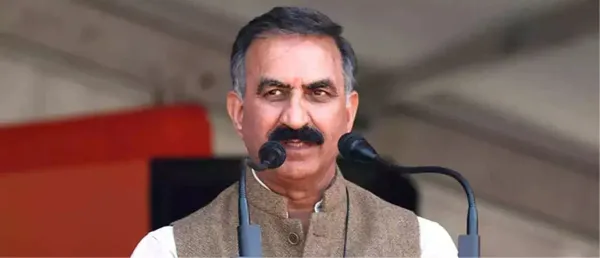

Sharing thoughts, Anurag Jain, the Chairman and CEO of Access Healthcare, said, “Healthcare organizations are facing unprecedented challenges in navigating complex reimbursement systems and the need to maintain financial sustainability. New Mountain has a strong track record of partnering with founder-led businesses. By delivering innovative, technology-driven solutions to clients, our platform improves their financial performance and enhances the overall patient experience.”

New Mountain Capital’s engagement in the sector includes a $6 billion buyout proposal for R1 RCM in July, though other private equity firms ultimately secured the acquisition.

Access Healthcare’s founder, Jain, is also known for his entrepreneurial ventures, including Brigade Corporation and Vision Healthsource.

His involvement in the US Major League Cricket tournament as co-owner of the Texas Super Kings highlights his diverse leadership portfolio.

Stay tuned for more such updates on Digital Health News