Cigna in Exclusive Talks to Sell Medicare Advantage Biz to HCSC for Close to $4 Bn

The potential sale to HCSC, the parent company of Blue Cross Blue Shield, could significantly bolster HCSC's geographic presence. Cigna's foray into the MA space began in 2012 with the acquisition of HealthSpring for $3.8 billion.

Cigna, a US-based health insurer, is in exclusive negotiation talks to sell its Medicare Advantage (MA) business to Health Care Service Corp (HCSC) for a reported sum ranging between $3 to $4 billion. The Wall Street Journal (WSJ) reported the development, citing insider sources.

Cigna had been actively seeking a buyer since November, with the motivation behind the move revealed during its third-quarter earnings call. At that time, Cigna acknowledged that its MA margins were trailing below the long-term targets of 4% to 5%. The plans' premium revenue in 2022 constituted 4.4% of the company's overall $180.5 billion revenue.

The potential sale to HCSC, the parent company of Blue Cross Blue Shield plans in several states, could significantly bolster HCSC's geographic presence. Cigna's foray into the MA space began in 2012 with the acquisition of HealthSpring for $3.8 billion. Since then, its MA enrollment has grown to nearly 600,000 members as of September.

Cigna's decision to pursue a sale comes on the heels of a failed attempt to acquire Humana in December. The stock market responded negatively, with a 10% drop in Cigna's stock price, leading to the abandonment of the merger.

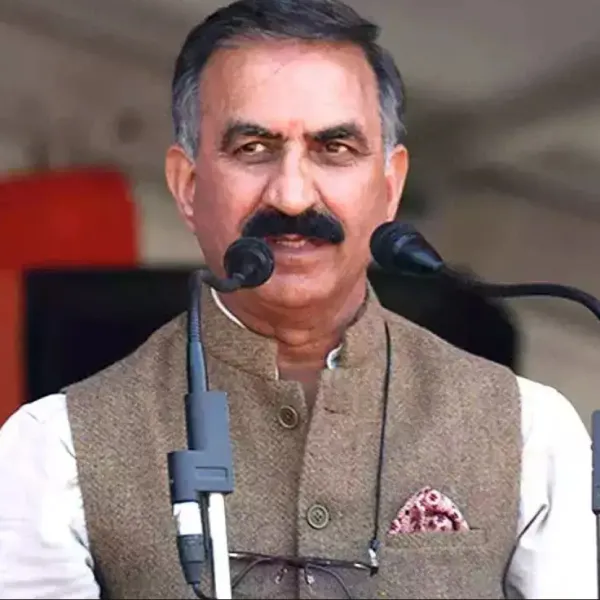

David Cordani, Cigna's CEO, had stated the company's commitment to "value-enhancing divestitures" at the time. The MA sale, if successful, would not only alleviate Cigna's financial concerns but also strategically benefit HCSC in expanding its footprint.

Cigna's history includes setbacks, such as abandoning a $48 billion deal to acquire Anthem in 2017 (now known as Elevance Health) and Aetna's termination of a $37 billion deal to acquire Humana, now owned by CVS Health.

Cigna's move to divest its MA business aligns with its strategic efforts to optimise its portfolio and address challenges in the ever-evolving healthcare landscape. The negotiations with HCSC mark a pivotal step in this ongoing corporate evolution.

Last year, Cigna Group faced a surge in lawsuits from members and shareholders after a ProPublica report alleged mass denial of members' claims without individual assessment, leading to the withholding of coverage for specific services.

The report, published in March 23, raised concerns about potential violations of state laws by Cigna, indicating that the company's medical directors denied many claims without thoroughly reviewing individual members' records. This process was facilitated by an automated claims review system called PxDx.

Stay tuned for more such updates on Digital Health News