ADMI Seeks Union Budget Reforms for Medical Devices Sector

Their focus includes addressing higher imports, the inverted duty structure, and the nonparity of Indian standards with international norms.

The Association of Diagnostic Manufacturers of India (ADMI) has laid out several critical demands ahead of the Union Budget 2024-25.

Their focus includes addressing higher imports, the inverted duty structure, and the nonparity of Indian standards with international norms.

Concerns Over Imports & Exports

According to ADMI, the Export Promotion Council for Medical Devices in 2023 (EPC-MD), constituted by the central government should address the industry's export issues.

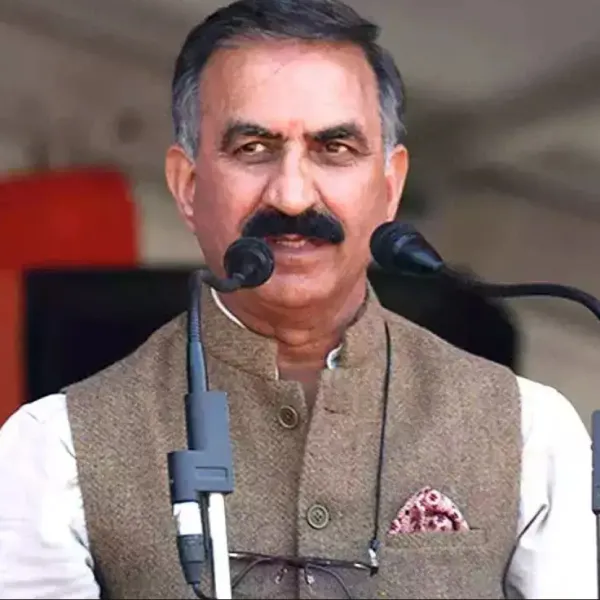

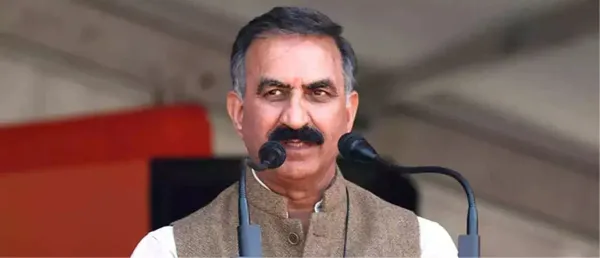

Sharing thoughts, Jatin Mahajan, secretary, ADMI, said, "The most critical aspect is exports-imports. Medical device exports from India stood at INR. 19,803 Cr (US$ 2.40 billion) in 2022 and are likely to reach US$ 10 billion by 2025 (IBEF). The government constituted the Export Promotion Council for Medical Devices in 2023. This body must be strengthened to address the industry's export issues adequately."

He further noted that the EPC-MD can accelerate international growth and must be empowered and fast-paced.

"The commerce ministry’s task force to address the exporters' woes of all exporters will hopefully also examine the MedTech exporters' woes and address their trade and technical barriers. A clear-cut path needs to be chalked out. We would certainly like to be addressed in the Budget, 2024," Mahajan added.

Call to Address Issues

One of the longest-standing issues in the medical devices sector is the inverted duty structure, where raw materials imports are taxed higher than finished imported products.

"The Government’s stoic inaction on this front is surprising and dismaying," Mahajan opined.

The Center's 2023 decision to permit refurbished medical device imports has also drawn criticism. ADMI argues that this policy contradicts the National Medical Device Policy 2023 and threatens Indian companies developing innovative solutions.

"This should be disallowed, except in critical cases where Indian solutions may not be available for the next few years," said Mahajan.

Quality standardization is another vital concern. ADMI urges the Government to ensure that Indian standards like ICMED and BIS are respected internationally.

"Without an ‘at-par’ status, Indian exporters will continue to face bottlenecks and be forced to seek multiple region/country-specific and product-specific certifications for exports," Mahajan stated.

Other Major Concerns Raised

Government procurement policies are another area of concern. According to ADMI, India's procurement policy favors imported devices, neglecting domestic manufacturers.

The association said, "Purchase preference policy for made-in-India products is toothless and ineffective."

Competent human resources and skill development are also urgent needs in the MedTech sector. ADMI calls for stronger industry-academia linkages and professional courses tailored to the industry's needs.

With the increasing influence of AI, ML, IoT, and telemedicine, ADMI stresses the need for a comprehensive AI and cyber security policy.

"The Government must take a leadership position and put the necessary framework in place to safeguard against cyber-attacks," said Mahajan, referencing the AIIMS cyber-attack in 2022.

India's position as a hub for frugal medical device engineering necessitates government-to-government and people-to-government interactions for technology transfers.

"There is an urgent need for government-to-government and people-to-government interactions and interfaces to transfer relevant technologies to India, as is happening in defense productions," Mahajan noted.

ADMI also highlighted other ongoing issues, such as insufficient raw materials, access to clinical trial samples, and the limited effectiveness of the PLI scheme for smaller players.

"For a prominent position in the global MedTech map, the government must address these concern areas on a war footing," Mahajan added.

Encouraging Developments

Despite the challenges, ADMI acknowledged positive developments in 2023, including the National Medical Devices Policy 2023 (NMDP 2023), the National Policy on R&D and Innovation in the Pharma-MedTech Sector, and increased medical device sector investments. Establishing various medical device parks nationwide is also a significant step forward, the ADMI observed.

India's global medical devices market share is 1.65%, positioning it fourth in Asia after Japan, China, and South Korea, and among the top 20 globally.

Stay tuned for more such updates on Digital Health News