Private Equity Infuses INR 4,900 Cr into Indian Healthcare in Q2 CY25

While deal volumes dropped by 21% compared to the previous quarter, the value of investments recorded a modest 3% increase, driven mainly by mid-sized transactions.

In Q2 of calendar year 2025, the Indian healthcare sector attracted private equity investments worth approximately INR 4,900 crore ($580 million) across 33 deals, according to a report from Grant Thornton Bharat.

While deal volumes dropped by 21% compared to the previous quarter, the value of investments recorded a modest 3% increase, driven mainly by mid-sized transactions.

This makes Q2 CY25 the second-highest quarter by value since Q2 2024.

“For the quarter, PE activity clustered around a few high-confidence, institutional-grade platforms, especially in pharma manufacturing and hospital chains, signalling investor preference for scale, visibility, and IPO readiness,” the report stated.

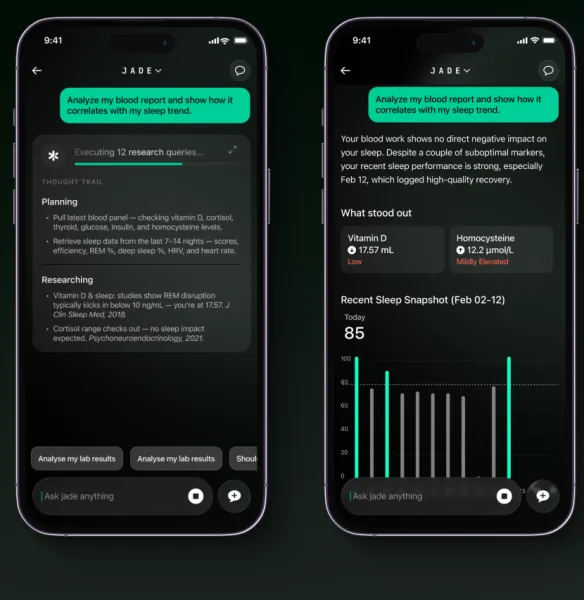

HealthTech led in deal count with 10 transactions, followed by Wellness (7 deals), Pharmaceuticals and Medical Devices (5 each), and Hospitals (4 deals).

Key transactions during the quarter included US-based General Catalyst’s seed round of $218 million in PB Healthcare and Advent International’s $175 million investment in Felix Pharma for a significant minority stake.

“In this quarter, Pharma and biotech led in value, powered by capital raises and strategic cross-border moves, while hospitals and healthtech platforms continued to evolve along distinct, high-potential growth paths,” said Bhanu Prakash, Partner and Healthcare Services Industry Leader, Grant Thornton.

“As preventive care and digital health gain ground, we expect sharper, more focused bets in the year's second half,” he added.

Stay tuned for more such updates on Digital Health News