Reliance Digital Health to Acquire 45% Stake in Health Alliance Group

The transaction is expected to conclude within two weeks, subject to customary closing conditions, as per a regulatory filing on December 21.

Reliance Digital Health Ltd (RDHL), a wholly owned subsidiary of Reliance Industries Ltd (RIL), announced the acquisition of a 45% equity stake in Health Alliance Group Inc. (HAGI) for $10 million.

The transaction is expected to conclude within two weeks, subject to customary closing conditions, as per a regulatory filing on December 21.

Focus on Virtual Healthcare Expansion

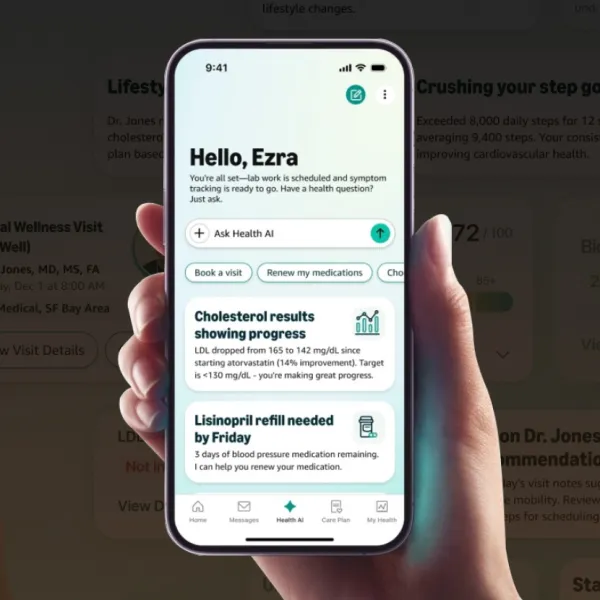

The investment aligns with RDHL’s aim to develop a virtual diagnostic and care platform, addressing healthcare access gaps globally, including in underserved communities. According to the filing, the transaction does not involve any related parties, and no governmental or regulatory approvals are required.

“The investment will empower Reliance Digital to develop a virtual diagnostic and care platform, expanding access to healthcare for underserved communities,” Reliance Industries stated in its filing.

Health Alliance Group, incorporated in Delaware on December 21, 2023, operates at the intersection of healthcare, information technology, and innovation. The US-based firm is focused on designing technology-driven solutions tailored to underserved populations in the United States, India, and other regions worldwide.

Details of the Transaction

The filing further clarified that this acquisition is not linked to any promoters or promoter groups associated with Reliance Industries.

“The transaction is subject to customary closing conditions and is expected to be completed in around two weeks. No governmental or regulatory approvals are required for the above transaction,” Reliance Industries confirmed.

Furthermore, this acquisition comes amid a period of growth and diversification for Reliance Industries. Its healthcare investments are part of a broader strategy to integrate digital innovation across sectors, including telecommunications and retail.

Shares of RIL closed 2% lower at INR1,206 on Friday on the Bombay Stock Exchange, reflecting broader market trends.

Stay tuned for more such updates on Digital Health News